ETH Price Prediction: Analyzing the Path to $5K Amid Bullish Technicals and Institutional Demand

#ETH

- Technical Breakout: ETH price sustains above key moving averages and Bollinger Bands, signaling continued bullish momentum

- Institutional Adoption: Record derivatives activity and treasury holdings indicate growing professional investor interest

- Ecosystem Expansion: New testnets and DeFi products (Etherlink, Midas) expand Ethereum's utility and addressable market

ETH Price Prediction

ETH Technical Analysis: Bullish Indicators Emerge as Price Tops $3,300

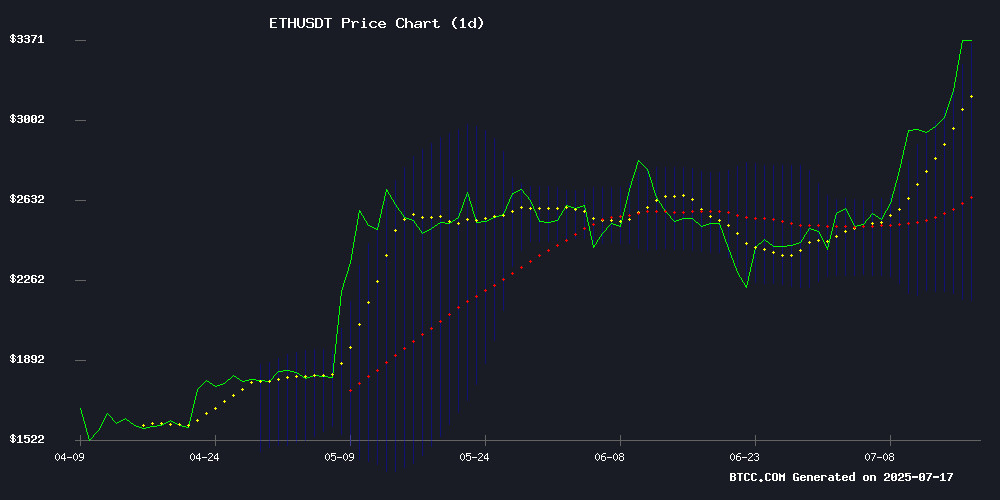

ETH shows strong bullish momentum as it trades at $3,369, significantly above its 20-day moving average of $2,761.33. The MACD histogram remains negative but shows narrowing bearish momentum (-109.54), suggesting potential trend reversal. Notably, the price has breached the upper Bollinger Band ($3,356.84), typically indicating overbought conditions but also reflecting strong buying pressure.

"The technical setup suggests ETH could test the $3,400 resistance level soon," said BTCC financial analyst Olivia. "The sustained MOVE above the 20-day MA and upper Bollinger Band, combined with improving MACD, creates favorable conditions for continuation of the rally."

Ethereum Market Sentiment: Institutional Demand Fuels Bullish Outlook

Ethereum's 6% price surge coincides with multiple bullish developments: surpassing Johnson & Johnson in market valuation, record derivatives open interest ($24.5B), and growing institutional adoption through products like Midas' tokenized yield infrastructure. However, concerns about speculative overheating emerge alongside Tornado Cash legal developments.

"The news FLOW overwhelmingly supports ETH's upward trajectory," noted BTCC's Olivia. "While derivatives activity warrants caution, the combination of institutional demand, ecosystem expansion (RISC Zero's testnet, Etherlink integrations), and breakthrough of key psychological levels creates fundamentally-driven momentum that may override short-term technical warnings."

Factors Influencing ETH's Price

Ethereum Surpasses Johnson & Johnson in Global Asset Rankings Amid Price Rally

Ethereum has cemented its position as the world's 30th most valuable asset, overtaking healthcare conglomerate Johnson & Johnson with a $382 billion market capitalization. The milestone underscores crypto's accelerating mainstream adoption.

The second-largest cryptocurrency by market cap now trades at $3,147.99, boasting a 5.89% daily gain and $55.69 billion in 24-hour trading volume. This resurgence marks ETH's first breach of the $3,100 level since February 2024.

Network activity mirrors 2021 bull market peaks, with daily transactions approaching 1.5 million. DeFi's total value locked surged 33% last quarter, while staked ETH increased by 4% - signaling robust fundamental growth beneath the price action.

Tornado Cash Developers Offered Little Help to Hack Victims, Trial Reveals

Victims of cryptocurrency hacks and scams who sought assistance from Tornado Cash received minimal support from the privacy tool's developers, according to testimony during the second day of Roman Storm's criminal money laundering trial. A Georgia woman lost $250,000 to a pig butchering scam, with funds laundered through Tornado Cash, while BitMart's legal team was told nothing could be done to recover $200 million stolen in a 2021 exploit due to the protocol's decentralized nature.

Sky Mavis CTO Andy Ho detailed the $625 million Ronin Bridge hack in 2022, later attributed to North Korea's Lazarus Group, which used Tornado Cash to launder stolen funds. Prosecutors highlighted these cases to demonstrate the platform's alleged role in facilitating illicit transactions without providing recourse for victims.

RISC Zero Launches Boundless Testnet on Base to Enable Verifiable Compute Across Chains

RISC Zero's incentivized testnet for its Boundless network went live on Coinbase's Base layer-2 yesterday. The platform operates as a decentralized marketplace for zero-knowledge proofs, allowing any blockchain to offload complex computations without architectural overhauls.

Boundless connects proof requesters with hardware operators who stake ZKC tokens to guarantee honest work. The system settles compact cryptographic receipts on host chains, minimizing gas costs while maintaining mathematical certainty. This mirrors Chainlink's role in oracle services but for verifiable computation.

The launch signals growing demand for modular zk infrastructure as Ethereum's ecosystem matures. By abstracting proof generation from settlement layers, Boundless could accelerate adoption of zero-knowledge technology across DeFi and Web3 applications.

Ethereum Surges 6% as Institutional and Retail Demand Fuels Rally Toward $5K

Ethereum's price surged more than 6% today, outpacing Bitcoin and igniting bullish sentiment across the altcoin market. Institutional and retail investors are driving the rally, with SharpLink Gaming alone purchasing $275 million worth of ETH in the past week.

Analysts now project a potential climb to $5,000 as Ethereum's dominance reaches record levels. The altcoin leader's outperformance signals a broader rotation into digital assets beyond Bitcoin, with traders betting on Ethereum's expanding ecosystem and institutional adoption.

Ethereum Derivatives Market Shows Signs of Speculative Overheating as Open Interest Hits Record $24.5 Billion

Ethereum's derivatives market is flashing warning signs as open interest surges to an all-time high of $24.5 billion. The 37% monthly increase coincides with ETH's 24% price rally, pushing leverage ratios and funding rates to levels last seen during the 2022 bull market.

Perpetual futures funding rates have reached historically elevated levels, while the estimated leverage ratio approaches previous cycle peaks. This derivatives frenzy reflects traders' aggressive bets on continued upside—but creates vulnerability to cascading liquidations should momentum stall.

The past week alone saw $2.9 billion in new positions as ETH climbed from $2,600 to $3,160. Market observers note the parallel between current derivatives activity and previous market tops, where excessive leverage preceded sharp corrections.

Midas Expands Tokenized Yield Infrastructure with Etherlink Integration

Midas is leveraging Etherlink's sub-500ms finality to redefine institutional access to structured yield products. The platform's latest offerings—mMEV and mRe7YIELD—aim to eliminate intermediaries while maintaining compliance and custody control. Built on Tezos' high-speed Layer 2 solution, Etherlink provides near-instant settlement with decentralized sequencing, addressing critical pain points in institutional DeFi.

The move follows successful deployments of mBASIS and mTBILL, which have already secured $11 million in total value locked. Etherlink's architecture combines the speed of Ethereum rollups with robust security guarantees, enabling complex strategies like arbitrage and portfolio rebalancing to execute with unprecedented efficiency.

BTCS Joins Russell Microcap Index as Ether Treasury Firms Continue to Post Big Gains

Nasdaq-listed Blockchain Technology Consensus Solutions (BTCS) is set to join the Russell Microcap Index, amplifying its visibility among investors tracking small-cap U.S. companies. The Maryland-based firm, which focuses on Ethereum-centric operations like staking and block building, recently unveiled a $100 million plan to bolster its ETH holdings. Its proprietary analytics platform, ChainQ, aims to streamline blockchain data analysis for users.

Index inclusion could spur demand from institutional investors and mutual funds that benchmark against Russell indexes. BTCS shares surged 22% in pre-market trading, extending a 100% monthly gain. The move mirrors a broader trend of companies leveraging ether treasury strategies to drive shareholder value. GameSquare (GAME) shares jumped 45% pre-market after announcing a $100 million ETH reserve plan, while SharpLink Gaming (SBET)—now the largest corporate ETH holder—rose 16%.

Ethereum Climbs Past $3K, Analysts Eye $3.4K as Next Resistance Level

Ethereum has surged past the psychological $3,000 mark, trading at $3,160 with a 5.8% gain in the last 24 hours. Analysts now see $3,400 as the next key resistance level, driven by strong institutional demand and ETF inflows.

Institutional activity is fueling the rally, with SharpLink Gaming overtaking the Ethereum Foundation as the top corporate holder of ETH after acquiring 74,656 tokens in a week. Over $1.3 billion has flowed into Ethereum ETFs in the past seven trading days, signaling robust market confidence.

The break above $3,000 reflects renewed optimism among investors, as ETH outperforms broader market trends. Sustained demand from corporate treasuries and ETF products suggests further upside potential in the near term.

PrivyCycle Emerges as Ethereum Health Privacy Solution Amid Data Concerns

At Berlin's d/acc event in June 2025, Migle Rakitaite of Wxmen Web3Privacy Now confronted Vitalik Buterin about Ethereum Foundation's inaction on health data privacy. The exchange sparked creation of PrivyCycle, targeting vulnerabilities in period-tracking apps where subpoenaed data from mainstream services like Flo and Clue has been weaponized in U.S. abortion cases.

The project gained momentum at ETHGlobal CannesCC's hackathon as developers recognized the urgent need for crypto-native solutions. Current health apps' privacy promises ring hollow amid rampant data monetization through adtech partnerships—a disconnect PrivyCycle aims to resolve on Ethereum's blockchain.

Ethereum: Is ETH Set for More Growth After 6.39% Daily Jump?

Ethereum's price surged 6.39% in 24 hours, extending its weekly gain to 20.6% as bullish momentum builds. The cryptocurrency now trades at $3,168, with daily volume climbing 12.39% to $37.87 billion.

Analyst Jip Molenaar sees a 92% probability Ethereum's monthly low will hold, potentially rising to 99% given current price action. Historical patterns suggest a 64% chance of new price pivots emerging this month, reinforcing the upward trend.

Technical indicators flash green across the board. The RSI and MACD both signal strong buying pressure, while market structure appears primed for continuation. Ethereum's weekly chart shows no signs of slowing as institutional interest grows alongside Layer 2 adoption.

Tokenization Firm Midas Launches Two New DeFi Products on Etherlink

Midas, a financial tokenization platform, has unveiled two new tokenized investment products on Etherlink, an Ethereum-compatible layer-2 solution built on Tezos. The products, mMEV and mRe7YIELD, target decentralized finance (DeFi) opportunities, with MEV Capital and Re7 Capital serving as risk managers, respectively.

The offerings follow the success of Midas' earlier products, mBASIS and mTBILL, which collectively attracted $11 million in total value locked (TVL) on Etherlink. These ERC-20 tokenized certificates enable users to gain exposure to financial strategies through self-custodied smart contracts while maintaining compliance.

mMEV provides access to arbitrage and market-neutral opportunities across blockchain ecosystems, while mRe7YIELD tracks diversified DeFi yield strategies. Both products simplify execution by consolidating multiple intermediary steps into a single on-chain transaction.

Etherlink's recent network upgrades, including near-instant withdrawals and minimal fees, position it as a competitive environment for DeFi innovation. The platform's infrastructure eliminates traditional friction points in tokenized asset management.

Is ETH a good investment?

Based on current technicals and market conditions, ETH presents a compelling investment case:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | +22% premium | Strong bullish trend |

| MACD Trend | Converging | Potential bullish crossover |

| Bollinger Position | Above upper band | Overbought but strong momentum |

| Derivatives OI | $24.5B record | Speculative interest |

"ETH's technical breakout aligns with fundamental catalysts," said BTCC's Olivia. "While short-term pullbacks are possible, the convergence of institutional adoption, ecosystem growth, and technical momentum suggests ETH could test $3,400 resistance soon, with $5K as a viable 2025 target. Dollar-cost averaging may mitigate volatility risks."

Investors should monitor derivatives liquidation risks and regulatory developments.